European and Asian auto manufacturers are concerned about the impending tariff rates hinted at by the Trump administration last May. U.S. government officials have threatened imposing a twenty-five percent import tariff on European and Asian made automobiles and auto parts. Currently, the United States is experiencing a trade deficit from these regions – with Europe charging a ten percent auto import tariff and China charging twenty-five percent, while the U.S. only charges two and a half percent – and they seek to level the playing field. However, in an effort for fairness, auto industry leaders fear significant consequences if the U.S. proceeds with its tariff proposal.

What is the Tariff Proposal?

In May 2018, the U.S. Department of Commerce submitted a proposal to increase U.S. auto import tariffs from two and a half percent to as much as twenty-five percent. This tariff would cover both fully assembled cars and car parts imported into the U.S. At this time, the Trump administration is debating whether or not to implement the tariff increase and if so, to what extent.

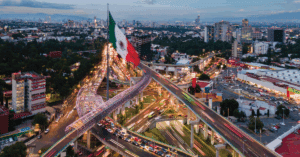

These tariffs will be widespread for any foreign auto imports, not just from specific nations. According to Drewry, a UK-based shipping consultancy firm, the greatest impact will be to nations like Japan and China, making up the majority of auto imports from the eastern nations, and Germany from the western nations. North American imports, from Canada and Mexico, will remain largely unaffected due to negotiations in the USMCA trade deal. Each country is permitted to ship 2.6 million vehicles into the U.S. before facing the increased rate.

Many expect the tariffs to be set in place during the second quarter of 2019 (around mid-May) and will see the effects during the fourth quarter.

Possible Proposal Effects

The tariff proposal has led many to be concerned about the state of trade between the U.S. and other foreign nations. Many are concerned about their effects on U.S. consumers and American jobs. But – some feel that the tariffs are necessary to help foreign trade partners see reason and level the playing field with the U.S.

Trade Relations

Industry leaders, like China, are not pleased with the tariff proposal but appear to be willing to work with the U.S. on its trade imbalance. Chinese President, Xi Jinping, said in a recent speech, “China does not seek trade surplus; we have a genuine desire to increase imports and achieve greater balance of international payments under the current account,” but also plans a “counterattack with great strength” for the U.S. if it pursues the increase.

German auto manufacturers also appear to show concern for the tariff increase. According to Automotive News Europe, the twenty-five percent rate would cause German car imports to decrease by nearly fifty percent or $19.2 billion. They anticipate exports from other sectors and to other markets to mitigate the losses but still expect a $13.11 billion loss. Germany currently has a $22 billion trade surplus over the U.S.

Drewry has published a white paper detailing the expected results of the tariffs at five, fifteen, and twenty-five percent. They find that finished cars and automobile part imports could decrease as much as eleven percent if the U.S. introduces the twenty-five percent rate as expected. Foreign nations are remaining patient as the U.S. decides how to act on these proposals. But, many fear a trade war on the horizon.

Consumer Effects/American Jobs

The National Automobile Dealers Association says the tariff proposals pose threats to manufacturers, dealers, and customers. They say the tariffs will lead to:

• Higher new and used vehicle prices

• Loss of dealership jobs

• Loss of state and local tax revenue

• Decline in fleet turnover

NADA feels that the protectionist efforts proposed by the administration are well-meaning, but come with unforeseen costs to Americans. NADA Chairman Wes Lutz said consumers would feel the effects through, “a combination of higher prices and fewer choices, as all imported vehicles and even U.S. built vehicles get dramatically more expensive, and some imported models are no longer offered for sale in the U.S. altogether.” The European Union has estimated that if a twenty-five percent tariff were added to vehicle prices for cars like BMW or Mercedes Benz, it would add an additional $11,300 to car prices – limiting more consumers from their purchase.

According to Lutz, auto manufacturing in the U.S. is not what it once was and the line between foreign and domestic cars has blurred. Over half of the cars sold in the U.S. are foreign or international nameplate vehicles. Around forty-four percent of international nameplate vehicles sold in the U.S. are being assembled in the U.S. and many “domestic” cars are being assembled outside of the U.S. So, by increasing the input costs for manufacturing (parts, raw steel or aluminum, etc.) U.S. jobs are in jeopardy.

Level Playing Field

The White House is defending its policies saying that is, “aggressively fighting predatory foreign trade practices, breaking down barriers to American exports, addressing the theft of intellectual property and designs, and challenging market-distorting industrial subsidies that continue to harm American industries.” Under the leadership of Secretary of Commerce, Wilbur Ross Jr., the DOC has increased trade investigations fourfold and continues to issue tariffs and quotas to help American industries “get back on their feet.”

These tactics, while discouraged by many, have shown promise with several of the U.S. trade partners. President Xi has stated that Beijing will “significantly lower” its own tariffs on auto imports in an effort to restore balance and ease restrictions for foreign vehicle ownership. Also, the EU is experiencing “sluggish growth” of its own and is eager for trade stimulus. Restoring balance with the U.S. could give them the boost they need to jumpstart their economy. “We are prepared to put our vehicle tariffs on the negotiating table as part of a broader agreement if the US agrees to work together towards zero tariffs for all industrial goods,” says Cecilia Malmstrom, EU trade chief.

Proposal Alternatives

“We understand the desire to achieve a level playing field in international trade, but tariffs are the wrong approach,” says the Alliance of Automobile Manufacturers. “We urge the Administration to not impose auto tariffs but rather, improve our national economic security by concluding trade pacts with key partners such as the E.U., Japan, and the U.K., and exploring additional market access opportunities for U.S. auto exports.”

The USMCA is an example of trade pacts in action, and averting the need for punitive tariffs. The U.S. working with Canada and Mexico has brought the trade partners to an understanding and has essentially leveled the playing field for the U.S. with its trade partners. Many Americans are eager for the administration to do the same with other trade partners.

The TPP was a trade agreement to reach out to several nations in the Pacific, but was not ratified by the U.S. due to President Trump’s view of an imbalance for U.S. trade. The U.S. could pursue other deals with these members and make similar deals with the UK or EU that would ensure each partner is acting fairly and relieve the need for higher tariffs.

With the threat of higher tariffs looming, many nations may be ready to come to the bargaining table and build fair agreements.

The U.S. is facing a significant trade deficit – as much as $500 billion last year. Trade partners like China and the EU are not acting fairly and charge four to ten times as much as the U.S. for automobile imports. As a result, the U.S. has threatened to increase its own tariffs in order to protect American businesses and show the world its intention for fair-play. Many are worried that these tariffs will do more harm than good for the U.S. in increased auto prices, fewer jobs, and fewer purchase options. Whether or not the threat will result in an all-out trade war is not yet known, but so far, the Trump administration’s gambit is appearing to pay off.