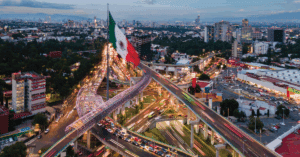

The U.S.–Mexico trade corridor has always been one of the most dynamic, active corridors in North America. For companies like ProTrans, which specialize in cross-border transportation, northbound/southbound freight consolidation, and customs brokerage, the recent updates to trade and customs policies are reshaping how freight moves between the two countries.

From tighter tariff enforcement under the USMCA to new air cargo restrictions, these shifts are impacting how capacity, routing, and compliance are managed on both sides of the border.

The Shifting Landscape of U.S.–Mexico Trade

Trade between the U.S. and Mexico hit record highs in early 2025, driven by manufacturing growth in northern Mexico’s Bajío corridor and the continued push toward nearshoring. But with rapid growth comes new layers of regulation.

Recent U.S. Department of Transportation (DoT) actions and new customs rulings have added complexity across several logistics sectors:

- Belly Cargo Restrictions: The U.S. has proposed banning belly cargo on flights between Mexico City International Airport (MEX) and U.S. destinations. This policy would affect carriers such as Aeroméxico, Viva Aerobus, and Volaris, with potential implementation scheduled to begin in mid-2026.

- Air Cargo Disruptions: The move is largely a response to Mexico’s decision to relocate freighters from MEX to Felipe Ángeles International Airport (AIFA), which reduces available capacity and creates competitive challenges.

- Tariff and Enforcement Actions: Under the USMCA, enforcement of labor and environmental clauses is ramping up, adding layers of compliance requirements for importers and exporters.

- Customs Modernization: Both countries have increased scrutiny of cross-border shipments, tightening inspection standards and digital record requirements.

For shippers and logistics providers, the impact is twofold: reduced air capacity and increased regulatory friction. Yet, these same challenges create opportunities for cross-border trucking and customs brokerage—areas where ProTrans delivers expertise and flexibility.

Rising Cross-Border Trucking Demand

With potential reductions in air cargo, trucking capacity across the border is poised to become increasingly strategic. Carriers and shippers are already seeing:

- Increased Truckload and LTL Demand: Especially for time-sensitive freight redirected from MEX–U.S. air lanes.

- Diversification of Gateways: More freight shifting toward Laredo, El Paso, and McAllen, as well as Mexican hubs in Monterrey and Querétaro.

- Rate Adjustments: As air capacity tightens, pricing is expected to rise across both modes, with over-the-road transport absorbing displaced volumes.

- Higher Compliance Complexity: Shippers must now meet evolving USMCA documentation standards, enforce origin tracing, and remain vigilant in response to customs audits.

Logistics partners support customers in this evolving environment by providing integrated cross-border transportation management that combines customs brokerage, real-time visibility tools, and supply chain optimization across multiple modes.

The Strategic Edge of a Logistics Partner

As trade policies continue to shift, logistics providers are not just managing freight—we’re advising on strategy, providing tailored solutions that mitigate risk and maximize efficiency, including:

- Customs Brokerage Services: Managing new tariff codes, digital documentation, and regulatory changes with precision.

- Dynamic Routing Solutions: Real-time route optimization to offset congestion and capacity fluctuations at key crossings.

- Supply Chain Visibility: Advanced tracking and predictive tools that keep freight moving despite policy shifts.

- Trade Compliance Expertise: Ensuring clients meet every aspect of USMCA and customs protocols through proactive review.

These capabilities make the difference between delay and delivery when market conditions tighten.

What’s Next for Border Trade?

The DoT’s recent actions signal a broader policy shift—using trade leverage to push for reciprocity. Mexico’s ban on freighters at MEX and its limited cooperation on route expansion triggered U.S. retaliation, impacting both air cargo and future bilateral approvals.

While officials stress that the goal is balance, not escalation, near-term cargo capacity could tighten further. That uncertainty means logistics operators need to stay nimble.

However, this shift may also strengthen regional logistics, particularly around cross-border services. As air cargo options narrow, trucking and intermodal services will likely gain traction, reinforcing Mexico’s northern industrial zones and the U.S. border corridor.

What Shippers Should Do Now

To stay ahead of these changes, businesses moving freight between the U.S. and Mexico should:

- Review routing options to account for possible air cargo restrictions.

- Reassess mode mix—consider shifting time-sensitive freight to premium ground or dedicated cross-border trucking.

- Engage with experienced customs brokers to stay compliant under new USMCA enforcement actions.

- Leverage data visibility tools to anticipate disruption and maintain customer commitments.

- Partner with a strategic logistics provider, such as ProTrans, to consolidate logistics functions under a single, managed platform.

The future of U.S.–Mexico trade will be shaped by evolving regulations, air cargo restrictions, and the expanding role of cross-border trucking. For shippers, adaptability is key—but not every company can absorb these complexities alone.

ProTrans provides the expertise, infrastructure, and visibility to keep your supply chain steady as the rules shift. Whether you’re moving goods through El Paso or managing compliance from Monterrey, our integrated solutions are built to deliver performance under pressure.

Ready to strengthen your cross-border strategy? Contact ProTrans today to build a compliant, cost-efficient logistics plan that keeps your freight—and your business—moving forward.